Taxation of cost cases do not generally have happy endings for recovering eDiscovery costs. The United States Court of Appeals for the Sixth Circuit issued a very important opinion on March 17, 2015 well grounded in the reality of civil litigation and the law where eDiscovery costs were recovered.

It also takes a swing at Race Tires, which is always a welcome read.

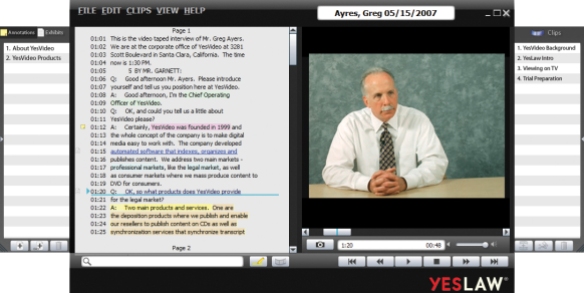

The Court of Appeals held that the cost of video deposition synchronization and transcript were properly taxed. Colosi v. Jones Lang LaSalle Ams., Inc., 2015 U.S. App. LEXIS 4184, 2-3 (6th Cir. Ohio 2015). The Trial Court had determined the synchronized video deposition was “reasonably necessary” and the opposing party never explained how the costs were either unreasonable or unnecessary. Id.

For anyone who has conducted deposition review, this is good news. I have spent many hours reviewing depositions and video depositions. “Reasonably necessary” is an understatement. Synced video depos allow you to understand the context of the testimony. A simple question and answer in a transcript can look harmless, but if the video shows the deponent turning bright red, biting his lip, and answering the question with his teeth clinched, you know that testimony is important.

The Court of Appeals further allowed the recovery of costs for imaging a hard drive. The Court stated:

Imaging a hard drive falls squarely within the definition of “copy,” which tellingly lists “image” as a synonym. And the name “imaging” describes the process itself. Imaging creates “an identical copy of the hard drive, including empty sectors.” The image serves as a functional reproduction of the physical storage disk. From the image file, one can access any application file or electronic document on the hard drive with all that document’s original properties and metadata intact. Id. If not actually made or formed in the image of the hard drive, we certainly regard it as such. Thus, a plain reading of the statute authorizes courts to tax the reasonable cost of imaging, provided the image file was necessarily obtained for use in the case.

Colosi, at *6, citing CBT Flint, 737 F.3d at 1328 (quoting The Sedona Conference, The Sedona Conference Glossary: E-Discovery & Digital Information Management 27 (Sherry B. Harris et al. eds., 3d ed. 2010)) and 1329-30.

I think it is extremely significant that the Court held that the imaging a hard drive “making a copy” and falls within the plain meeting of the taxation of costs statute.

The Court further stated that the Race Tires court “ignored § 1920’s text.” Colosi, at *8. The Court explained:

We need not ask whether imaging is the “functional equivalent” of making photocopies in the era before electronic discovery because—consistent with the 2008 amendments—the procedure comes within the ordinary meaning of “making copies of any materials.” While the Third Circuit rightly worried over expanding the scope of § 1920 to include expensive electronic discovery procedures not contemplated by Congress, this concern more appropriately pertains to the context-dependent question of whether the prevailing party necessarily obtained its copies for use in the case.

Colosi, at *8; Taniguchi, 132 S. Ct. at 2002—06 (beginning its interpretation of § 1920 with the ordinary meaning of words before examining statutory context).

The biggest take away from this case is a Court stated a reality of electronic discovery: an image of a hard drive is a copy.

Reblogged this on Michigan e-Discovery and commented:

6th Circuit, allowing eDiscovery cost when “Reasonably Necessary.”